|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Options to Refinance a Home: A Comprehensive GuideRefinancing your home can be a strategic move to lower your mortgage payments, shorten your loan term, or tap into your home's equity. This guide explores the best options available for refinancing a home, providing insights and tips for homeowners seeking to optimize their mortgage. Understanding Home RefinancingHome refinancing involves replacing your existing mortgage with a new one, often to secure better terms. The primary goal is to save money over the life of your loan, although motivations can vary depending on personal financial goals. Why Refinance Your Home?

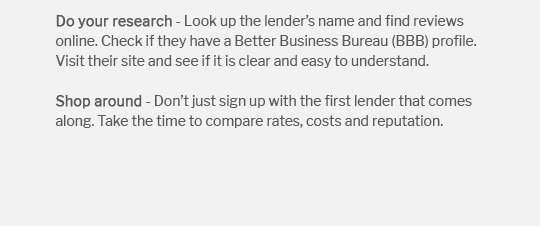

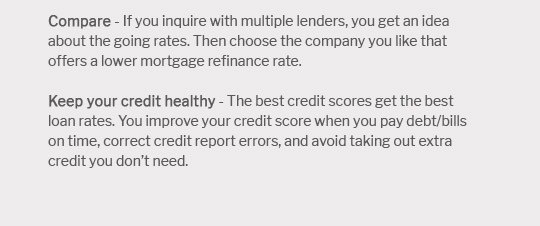

Types of Home Refinancing OptionsUnderstanding different refinancing options is crucial to choosing the best one for your financial situation. Rate-and-Term RefinanceThis is the most common type of refinancing. It aims to change the interest rate, the term of the loan, or both, without altering the principal balance. Home refinance rates in Arizona can vary significantly, so it's essential to shop around for the best deal. Cash-Out RefinanceFor homeowners looking to access their home's equity, a cash-out refinance allows you to borrow more than you owe, providing cash that can be used for renovations, debt consolidation, or other expenses. Steps to Refinance Your Home

Frequently Asked QuestionsWhat are the costs involved in refinancing?Refinancing costs can include application fees, origination fees, appraisal fees, and closing costs. It's crucial to compare these costs against the potential savings from a lower interest rate. How long does the refinancing process take?The refinancing process typically takes 30 to 45 days, depending on the lender and your financial situation. Can I refinance if I have bad credit?It may be more challenging to refinance with bad credit, but it's possible. Consider working with lenders who specialize in loans for those with less-than-perfect credit. ConclusionRefinancing your home can offer substantial financial benefits if approached with careful consideration and planning. By understanding the types of refinancing options available and the steps involved, you can make an informed decision that aligns with your financial goals. Remember to compare offers from different lenders and assess all costs involved to ensure you choose the best option for your situation. https://www.rocketmortgage.com/learn/types-of-refinance

An FHA Streamline refinance can be a great option for homeowners with Federal Housing Administration (FHA) loans who are looking to lower their ... https://mortgageequitypartners.com/top-6-options-for-mortgage-refinance/

A rate-and-term refinance involves replacing your existing mortgage with a new one that has a different interest rate, term, or both. https://myhome.freddiemac.com/refinancing/options-for-refinancing

If you are considering refinancing your mortgage, there are two primary options you'll need to choose between: no cash-out refinance and cash-out refinance.

|

|---|